How to glean insights from impression share to boost PPC performance

Impression share metrics let you identify meaningful optimizations for your paid search campaigns. Here’s how to calculate them at scale.

I’m a proponent of leveraging impression share metrics to identify meaningful optimizations for my paid search campaigns.

The insights don’t necessarily come from the impression share itself, but the impression share lost due to rank or budget.

This article we’ll cover:

- What each metric represents.

- Tips for calculating these metrics at scale in a spreadsheet.

- How to take action based on the results of your analysis.

Defining impression share and related metrics

Here’s what each metric means:

- Impression share (IS): The percentage of impressions your ads receive compared to the total number of impressions your ads could get.

- Impression share lost due to budget: The percentage of impressions your ad would have received if you had an unlimited budget.

- Impression share lost due to rank: The percentage of impressions your ad would have received if your ad had the highest rank.

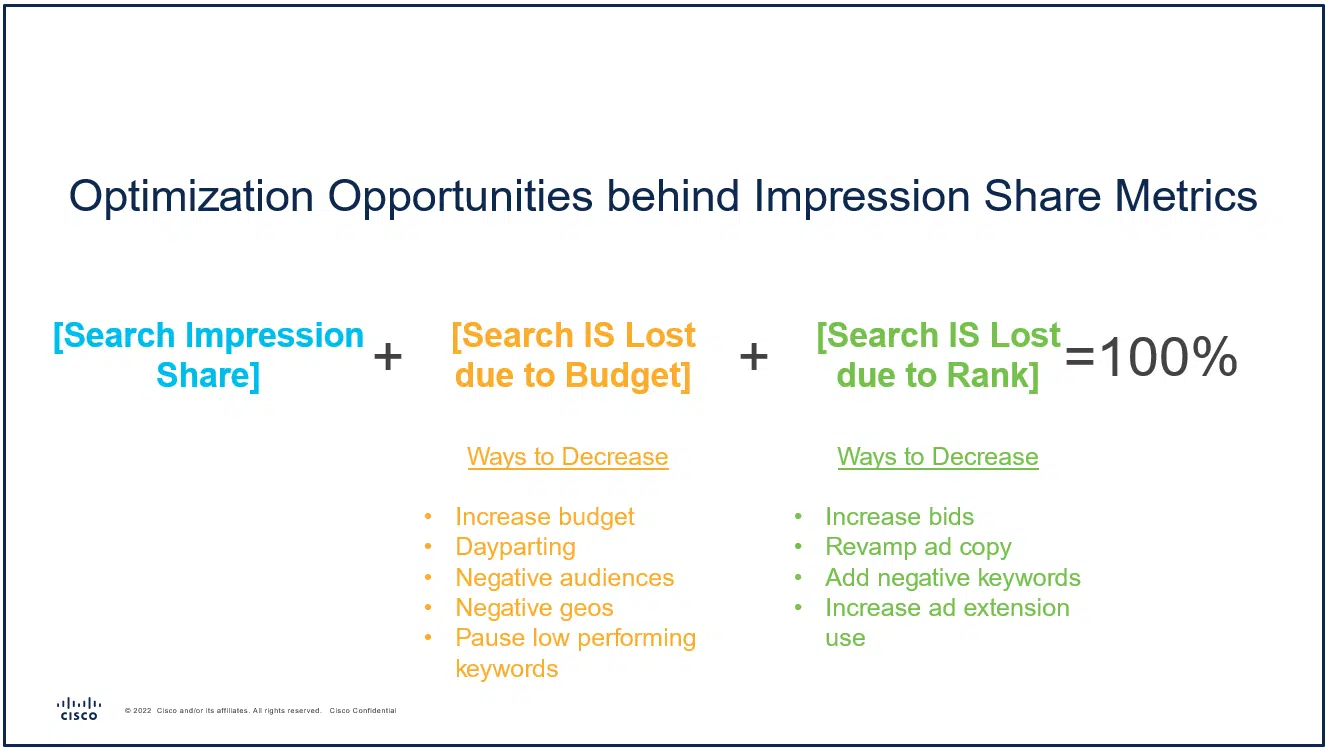

Though it might be obvious, note that the sum of these three metrics is 100%.

This is important because it can help you identify the potential impact of different optimizations. If one is significantly higher than the other, you know where to exert your energy.

Calculating impression share at scale

If you are familiar with my content, you are likely aware that I minimize my time on activation platforms and focus my energy on number crunching. (Surprise, surprise!) It’s no different with impression share metrics.

Understanding that the sum of these three metrics equals 100% also gives you the tools needed to aggregate impression share calculations at scale. It’s simply a math formula that we can replicate in a spreadsheet using basic calculations.

Before jumping into the technique, I will note that using filters in the platform should always be the source of truth, especially if you frequently see the infamous impression share of “<10%” in your account.

The below is meant to provide mathematically-backed estimates and enhance your analytical abilities, especially when dealing with a lot of data. Always go with what you see in the platform if you’re reporting to your stakeholders.

When I do see “<10%” in my analysis, I first attempt to subtract the IS Lost (Rank) and IS Lost (Budget) from 1. If either of those metrics shows as “>90%,” I use an assumption of 5%. If you include the 5% estimate, this will inherently expose you to slight accuracy risks.

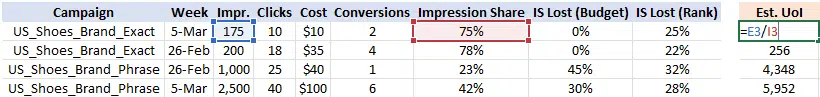

The first step is calculating what I refer to as the “Universe of Impressions,” or UoI, which represents the total possible number of impressions. (I’m unsure if this metric has an official name.)

Since we know how many impressions our campaign generated and that impression share represents the proportion of the total possible impressions you showed, we can simply divide the impressions by the impression share to know the total possible impressions or UoI.

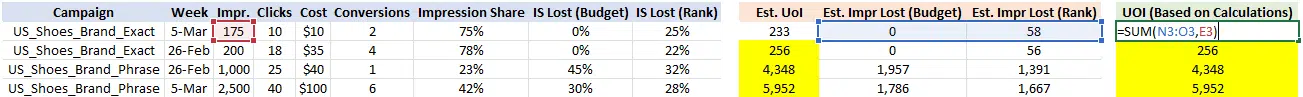

Now that we know the total number of impressions, we can calculate the estimated impressions we lost due to budget constraints by multiplying the UoI by the IS Lost (Budget).

We replicate this same calculation using IS Lost (Rank) to calculate the estimated number of impressions we’re losing to poor ranking in the auctions. I’ve combined those steps in the next screenshot.

You can always check your math by summing your impressions, estimated impressions lost (budget), and estimated impressions lost (rank) and comparing them to the UoI.

If your math is right, they should be identical.

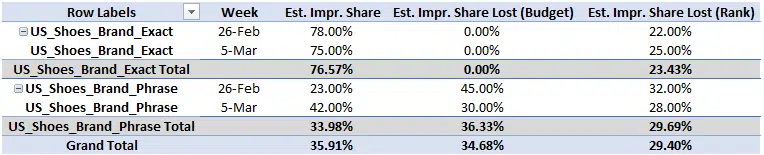

The final step is creating a pivot table with calculated fields representing our three impression share metrics using the column titles above.

- Estimated impression share:

- [Impr.] / [Est. UoI]

- Estimated impression share lost due to budget:

- [Est. Impr. Lost (Budget)] / [Est. UoI]

- Estimated impression share lost due to rank:

- [Est. Impr. Lost (Rank)] / [Est. UoI]

With this approach, you can now adjust your pivot table and see a dynamic calculation of impression share based on the filters and inputs you include.

To illustrate this, I’ve included the highlighted campaign totals across the two weeks. Feel free to use the screenshots above to check my math.

If you find tips like these useful, I encourage you to check out my previous article on Excel pivot table best practices for search marketers.

Optimizing based on your impression share insights

Now that you’ve done all your number crunching, it’s time to turn the analysis into action.

You know what is best for your business, and many optimizations are at our disposal.

I’ve attempted to summarize how I approach optimizations based on what I see in the impression share metrics. But in reality, the lines blur between these boxes.

For example, you could increase your bids to help improve the bottom right corner scenario (high IS lost due to rank and high IS lost due to budget).

One tip I’d encourage you to implement within your campaigns is to focus on driving down impression share lost due to budget, even if that means shifting the IS lost from budget to rank.

Most advertisers can’t make budget magically appear to solve the “IS lost due to budget” problem.

This mindset will generally lead to more effective performance, as shifting the IS lost from budget to rank likely means you are culling down your campaigns or getting “stingier” about spending the budget.

To finish, here are some of my favorite approaches to limit the scope of campaigns, if that’s the optimization that makes the most sense:

- Dayparting.

- Keyword pauses.

- Segment-based negations. (Audiences, geos, devices… you name it!)

- Negative keywords.

If we’re focused on improving quality scores, here are the ways I typically try to approach this:

- Ad copy refreshes.

- Increasing the number of extensions in use.

- Negative keywords.

- Landing page testing.

It should be noted that there are other impression share metrics, such as top IS and absolute top IS.

The good news is that the calculations highlighted in this article apply to those metrics, too. They can be leveraged with general IS metrics to create more informed insights.